MIGRATION

Where you want to migrate?

CANADA

The right Canadian immigration program for you will depend on your characteristics, your goals..

EU CITIZENSHIP

Cypriot citizenship to non-Cypriot investors is available according to the “Scheme...

PERMANENT RESIDENCY VISA.

The fast-track (Category F) permanent residence permit has been ...

EB-5 IMMIGRANT INVESTOR PROGRAM

USCIS administers the EB-5 Program. Under this program ..

INVESTOR VISA GREECE

The golden visa program in Greece offers an affordable real estate investment...

INVESTOR PROGRAM

Police report or character report from risk management consultancy...

PORTUGAL

The Investment in Portugal developed and managed by the well known and ...

SPAIN GOLDEN VISA

Spain launched its golden visa program in 2013. An investment of €500,000 ..

GET EVALUATED

Migration is a highly technical process. Our Evaluation Experts analyze your profile to help you make an informed decision. Your Eligibility Evaluation report contains:

SCORE CARD

COUNTRY PROFILE

OCCUPATION PROFILE

DOCUMENTATION LIST

COST &TIME ESTIMATE

1. Canada:

The right Canadian immigration program for you will depend on your characteristics, your goals, and your particular situation.

The Canadian federal and provincial governments are constantly updating their programs to ensure that Canadian immigration is successful, both for newcomers and for Canada.

There are currently more than 80 programs available for immigration to Canada. For that reason, everyone’s path to Canadian immigration will be unique.

For example, there are many different categories for professionals and workers under which you might qualify for your Canada Immigration permanent resident visa, including the Federal and Quebec Skilled Worker programs, the Provincial Nominee Programs, the Canadian

Experience Class, the Quebec Experience Class, and the Federal Self-Employed program. Canada also offers a number of Family Class Sponsorship programs, whereby Canadian citizens and permanent residents may sponsor family members and loved ones for Canadian immigration.

Canada announced a Multi-Year Immigration Levels Plan, which is set to welcome an increased number of immigrants through economic programs, family sponsorship and other programs in the upcoming years.

The Government of Canada also affords LGBTQ2 individuals and couples the same rights and opportunities as other persons when it comes to immigration issues.

Available Canadian immigration programs

Federal Skilled Immigration

Foreign skilled workers and professionals are greatly needed in Canada.

One of the main goals of Canadian immigration is to welcome skilled newcomers who will contribute to Canada’s growing economy. Skilled workers who settle in Canada on a permanent basis are especially valuable to Canada’s economy and the strength of its workforce.

Successful applicants of the Skilled Worker Immigration programs will receive a Canadian Immigration (permanent resident) Visa, allowing the applicant to immigrate to Canada with his or her family.

As a skilled worker or professional, you have several options to consider. For example, you may be eligible to apply under Canada’s Federal Skilled Worker Class or, if your intended destination is in Quebec, the Quebec Skilled Worker Program may be the pathway for you and your family, if applicable. Moreover, if you know in which province or territory you plan to reside, you may be able to submit an application through one of the Provincial Nominee Programs. Below, you will find a list of those programs for you to explore. We also encourage you to start your free assessment.

Federal Skilled Worker Program: This program is for individuals with certain work experience who intend to reside in any province or territory outside of the province of Quebec.

Quebec Skilled Worker: Applicants who plan to immigrate to the province of Quebec may be eligible to submit an application through this program.

Provincial Nominee Programs (PNPs): Most provinces and territories have created their own skilled worker programs for those intending to live and work in their particular province or territory. These are fast-track Canadian immigration programs that allow candidates to receive a provincial nomination certificate. In most cases, a nomination certificate will allow candidates to immigrate more quickly than through other Canadian immigration programs.

Many Canadian employers are actively seeking foreign skilled workers to join their workforce as quickly as possible. If you can obtain a job offer from a Canadian employer, you may also qualify for fast-track Canadian immigration application processing.

Many Canadian citizens and permanent residents have loved ones abroad that they wish they could bring to Canada.

The Canadian government offers a number of ways to allow this dream to become a reality under its Family Class Sponsorship class. Canada’s Family Class Sponsorship programs are some of the most generous family reunification programs in the developed world. After all, the Canadian government is committed to keeping families together whenever possible.

There are a number of relationships that qualify for Family Class Sponsorship, including spouses and common-law partners, parents and grandparents, and dependent children. For parents and grandparents, there is also the Super Visa program.

Business immigration to Canada: An Introduction

Through Canada’s Business Class immigration programs, Canada aims to attract individuals that have a significant ability to contribute to the Canadian economy. These programs are offered with the goal of promoting economic development and bettering the job market by attracting investors, entrepreneurs, and self-employed individuals from outside Canada with available venture capital, significant business acumen, and entrepreneurial skills.

Business Class immigration also seeks to develop new commercial opportunities in Canada and to improve Canada’s access to growing foreign markets by welcoming foreign nationals who are familiar with those markets and their unique requirements and customs.

If this option sounds well-suited to your experience and goals, there are several immigration pathways from which to choose. Depending on where you plan to reside, you may choose to apply through one of the programs offered by a particular province, such as the Quebec business immigration programs, or by the federal government. Get started exploring your options by starting a free assessment, and we will be pleased to discuss your Business Class immigration options with you.

Provincial Nominee Program (PNP)

Provincial nomination offers a valuable route to Canadian permanent residence.

The Provincial Nominee Programs (PNPs) allow Canadian provinces and territories to nominate individuals who wish to immigrate to Canada and who are interested in settling in a particular province.

Each Canadian province and territory (except Nunavut and Quebec) has its own unique Provincial Nominee Program. Each PNP has at least one immigration stream that is aligned with the federal Express Entry immigration selection system.

Provincial nominations issued under these Express Entry-aligned streams are known as ‘enhanced nominations’ and award Express Entry candidates an additional 600 Comprehensive Ranking System (CRS) points.

With more than 80 provincial immigration streams, discovering the Canadian immigration pathway that best suits you may be challenging. The Canada PNP Finder is designed to help you discover the right immigration pathway to Canadian permanent residence, and track the latest Canada PNP updates. You can also view the results of all PNP draws conducted this year at this dedicated page.

Learn more about Canada’s PNPs by contacting us :

Alberta Immigrant Nominee Program (AINP)

British Columbia Provincial Nominee Program (BC PNP)

Manitoba Provincial Nominee Program (MPNP)

New Brunswick Provincial Nominee Program (NBPNP)

Newfoundland and Labrador Provincial Nominee Program (NLPNP)

Nova Scotia Nominee Program (NSNP)

Ontario Immigrant Nominee Program (OINP)

Prince Edward Island Provincial Nominee Program (PEI PNP)

Saskatchewan Immigrant Nominee Program (SINP)

Northwest Territories Nominee Program (NTNP)

Yukon Nominee Program (YNP)

Applying for Canadian Permanent Residence with a Provincial Nomination

Provincial Nominee Programs across Canada are actively seeking and retaining eligible foreign nationals by making the process of applying for Canadian permanent residence more accessible.

Whether a provincial nomination certificate is issued via Express Entry or outside the selection system, a nominee is still required to submit a separate application for Permanent Resident (PR) status to IRCC. Find out how long it may take a Canadian immigration application to process using our Canada Immigration Processing Times Tool.

The Northern Canada territory of Nunavut does not currently have a PNP and Quebec does not participate in the federal government’s PNP. Instead, the Governments of Quebec and Canada have entered into a series of agreements which enables the province of Quebec to establish its own selection criteria for economic immigration.

2. EU CITIZENSHIP

Cypriot citizenship to non-Cypriot investors is available according to the “Scheme for Naturalization of Investors in Cyprus by Exception” on the basis of Section 111A (2) of the Civil Registry Laws of 2002-2013, based on a Council of Ministers decision dated 13th September 2016 which established the financial criteria where the Cyprus Council of Ministers grants citizenship by naturalization.

Financial Criteria

Investment in Real Estate and Land Development

Residential Investment Scheme

Canada announced a Multi-Year Immigration Levels Plan, which is set to welcome an increased number of immigrants through economic programs, family sponsorship and other programs in the upcoming years.

The Government of Canada also affords LGBTQ2 individuals and couples the same rights and opportunities as other persons when it comes to immigration issues.

Available Canadian immigration programs

Federal Skilled Immigration

Foreign skilled workers and professionals are greatly needed in Canada.

One of the main goals of Canadian immigration is to welcome skilled newcomers who will contribute to Canada’s growing economy. Skilled workers who settle in Canada on a permanent basis are especially valuable to Canada’s economy and the strength of its workforce.

Successful applicants of the Skilled Worker Immigration programs will receive a Canadian Immigration (permanent resident) Visa, allowing the applicant to immigrate to Canada with his or her family.

As a skilled worker or professional, you have several options to consider. For example, you may be eligible to apply under Canada’s Federal Skilled Worker Class or, if your intended destination is in Quebec, the Quebec Skilled Worker Program may be the pathway for you and your family, if applicable. Moreover, if you know in which province or territory you plan to reside, you may be able to submit an application through one of the Provincial Nominee Programs. Below, you will find a list of those programs for you to explore. We also encourage you to start your free assessment.

Federal Skilled Worker Program: This program is for individuals with certain work experience who intend to reside in any province or territory outside of the province of Quebec.

Quebec Skilled Worker: Applicants who plan to immigrate to the province of Quebec may be eligible to submit an application through this program.

Provincial Nominee Programs (PNPs): Most provinces and territories have created their own skilled worker programs for those intending to live and work in their particular province or territory. These are fast-track Canadian immigration programs that allow candidates to receive a provincial nomination certificate. In most cases, a nomination certificate will allow candidates to immigrate more quickly than through other Canadian immigration programs.

Many Canadian employers are actively seeking foreign skilled workers to join their workforce as quickly as possible. If you can obtain a job offer from a Canadian employer, you may also qualify for fast-track Canadian immigration application processing.

Many Canadian citizens and permanent residents have loved ones abroad that they wish they could bring to Canada.

The Canadian government offers a number of ways to allow this dream to become a reality under its Family Class Sponsorship class. Canada’s Family Class Sponsorship programs are some of the most generous family reunification programs in the developed world. After all, the Canadian government is committed to keeping families together whenever possible.

There are a number of relationships that qualify for Family Class Sponsorship, including spouses and common-law partners, parents and grandparents, and dependent children. For parents and grandparents, there is also the Super Visa program.

Business immigration to Canada: An Introduction

Through Canada’s Business Class immigration programs, Canada aims to attract individuals that have a significant ability to contribute to the Canadian economy. These programs are offered with the goal of promoting economic development and bettering the job market by attracting investors, entrepreneurs, and self-employed individuals from outside Canada with available venture capital, significant business acumen, and entrepreneurial skills.

Business Class immigration also seeks to develop new commercial opportunities in Canada and to improve Canada’s access to growing foreign markets by welcoming foreign nationals who are familiar with those markets and their unique requirements and customs.

If this option sounds well-suited to your experience and goals, there are several immigration pathways from which to choose. Depending on where you plan to reside, you may choose to apply through one of the programs offered by a particular province, such as the Quebec business immigration programs, or by the federal government. Get started exploring your options by starting a free assessment, and we will be pleased to discuss your Business Class immigration options with you.

Provincial Nominee Program (PNP)

Provincial nomination offers a valuable route to Canadian permanent residence.

The Provincial Nominee Programs (PNPs) allow Canadian provinces and territories to nominate individuals who wish to immigrate to Canada and who are interested in settling in a particular province.

Each Canadian province and territory (except Nunavut and Quebec) has its own unique Provincial Nominee Program. Each PNP has at least one immigration stream that is aligned with the federal Express Entry immigration selection system.

Provincial nominations issued under these Express Entry-aligned streams are known as ‘enhanced nominations’ and award Express Entry candidates an additional 600 Comprehensive Ranking System (CRS) points.

With more than 80 provincial immigration streams, discovering the Canadian immigration pathway that best suits you may be challenging. The Canada PNP Finder is designed to help you discover the right immigration pathway to Canadian permanent residence, and track the latest Canada PNP updates. You can also view the results of all PNP draws conducted this year at this dedicated page.

Learn more about Canada’s PNPs by contacting us :

Alberta Immigrant Nominee Program (AINP)

British Columbia Provincial Nominee Program (BC PNP)

Manitoba Provincial Nominee Program (MPNP)

New Brunswick Provincial Nominee Program (NBPNP)

Newfoundland and Labrador Provincial Nominee Program (NLPNP)

Nova Scotia Nominee Program (NSNP)

Ontario Immigrant Nominee Program (OINP)

Prince Edward Island Provincial Nominee Program (PEI PNP)

Saskatchewan Immigrant Nominee Program (SINP)

Northwest Territories Nominee Program (NTNP)

Yukon Nominee Program (YNP)

Applying for Canadian Permanent Residence with a Provincial Nomination

Provincial Nominee Programs across Canada are actively seeking and retaining eligible foreign nationals by making the process of applying for Canadian permanent residence more accessible.

Whether a provincial nomination certificate is issued via Express Entry or outside the selection system, a nominee is still required to submit a separate application for Permanent Resident (PR) status to IRCC. Find out how long it may take a Canadian immigration application to process using our Canada Immigration Processing Times Tool.

The Northern Canada territory of Nunavut does not currently have a PNP and Quebec does not participate in the federal government’s PNP. Instead, the Governments of Quebec and Canada have entered into a series of agreements which enables the province of Quebec to establish its own selection criteria for economic immigration.

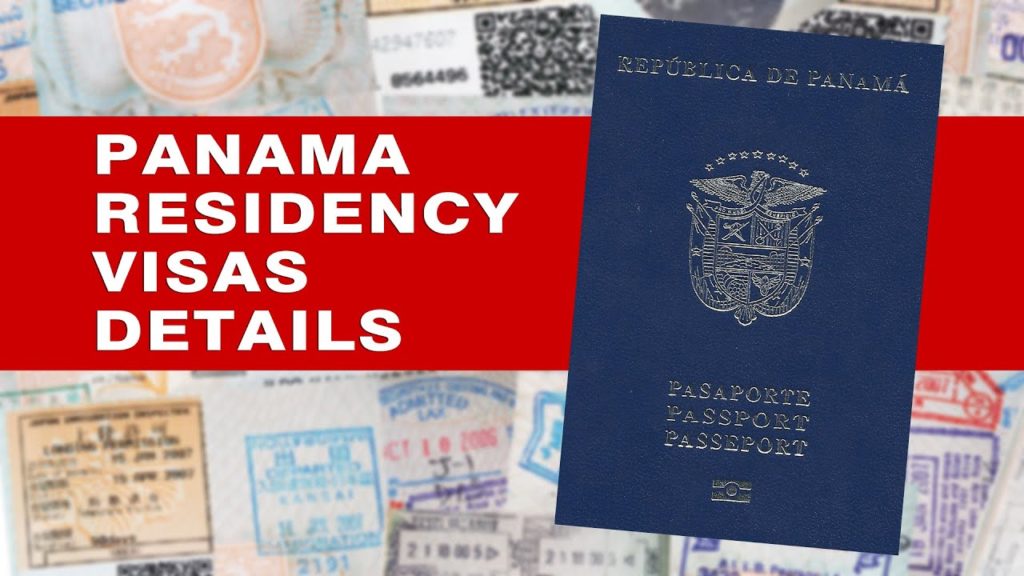

3. CYPRUS PERMANENT RESIDENCY VISA.

The fast-track (Category F) permanent residence permit has been introduced in pursuance of the provisions of Regulation 6(2) of the Aliens and Immigration Regulations, the Minister of Interior, having notified the Council of Ministers, has decided to issue an Immigration Permit to applicants from third countries who wish to invest in Cyprus provided they meet the requirements.

Financial Criteria & Conditions

Minimum of €300,000 in property net of Tax

Can be one or two new properties.

Must be sold for the first time from the same development company.

At least 1 must be residential while the other one can be residential, a shop of a surface of up to 100sq.m. or an office of a surface of up to 250sq.m.

Payment must be a transfer from abroad to a Cypriot financial institution.

Create a long term deposit of €30,000

Minimum of €30,000.

Transferred from abroad to a Cypriot financial institution.

Must be pledged to a Cypriot financial institution for at least a three year period.

Secure annual income of at least €30,000

Investor must prove secure income over €30,000 per year from businesses outside of Cyprus.

Income may include salaries from employment, pensions, dividends from shares, fixed deposits, rents etc.

This requirement is increased by €5,000 for every dependent person.

This requirement is increased by €8,000 for every parent of the applicant.

Benefits of the Program

The Permanent Residency VISA is forever

There is no need for renewal as long as the applicant still owns the property/ies worth €300,000 in Cyprus.

This VISA allows the holder to travel to Cyprus

No extra documentation is required.

The whole family can be issued the Permanent Residency VISA

Married couples, children under the age of 18 and parents of the applicants are also eligible for the PR VISA.

Unmarried children between the ages of 18 and 25, provided they are students or undergraduates and are financially dependent on the applicant. The VISA permit is still valid even if the holder has exceeded the age of 25 years old.

Property can be replaced

The investor can sell his/her property and still keep the VISA as long as he/she replace the property with another worth at least €300,000.

The VISA is issued within 2 months

Swift and simple procedure

Main Applicant

Valid passport

Original letter from a financial institution in Cyprus of a deposit of €30.000, pledged for three years

Declaration of a secured annual income from abroad of €30.000 at least Title of ownership or contract of sale of a built property in Cyprus of a minimum market value of €300.000 – If the title of ownership has not been obtained yet, the applicant must submit the contract of sale duly stamped and proof of payment of at least €200,000.

Detailed biography (CV)

Official statement of no intention to work in Cyprus

Health insurance policy

Clean criminal record

Spouse, Children and Parents (if applicable)

Health insurance

Marriage Certificate

Birth Certificates

Required documents for dependent children age 18-25

Valid passport

Detailed biography (CV)

Official statement of no intention to work in Cyprus

Letter of enrollment at tertiary education

Documents issued by a foreign authority should be translated to either English or Greek and duly authenticated

GOVERNMENT FEES

Submission fee €500 per application (covers the whole family)

Issue of the Permanent Residency Visa is €70 per person

PROCEDURE

Step1

Select your property

Review and choose the property/ies you want to purchase

Step2

Invest

Sign contract of sale

Transfer funds to a secure account.

Receipt issued by Crown Group of Companies

Step3

Preparing for the PR Application

Applicant must gather all necessary documents required for the application (see also required documents)

Step4

Submitting the application

Submit and pay personally or through an agent the application with all the required documents at the Civil Registry and Migration Department

Step5

Issue of PR VISA within 2 months

Collect personally or through an agent the VISA

Visit Cyprus at least once every 2 years

4. EB-5 IMMIGRANT INVESTOR PROGRAM

USCIS administers the EB-5 Program. Under this program, entrepreneurs (and their spouses and unmarried children under 21) are eligible to apply for a green card (permanent residence) if they:

Make the necessary investment in a commercial enterprise in the United States; and

Plan to create or preserve 10 permanent full-time jobs for qualified U.S. workers.

This program is known as EB-5 for the name of the employment-based fifth preference visa that participants receive.

About the EB-5 Visa Classification

Visa Classification Description

USCIS administers the EB-5 program, created by Congress in 1990 to stimulate the U.S. economy through job creation and capital investment by foreign investors. Under a program initially enacted as a pilot in 1992, and regularly reauthorized since then, investors may also qualify for EB-5 classification by investing through regional centers designated by USCIS based on proposals for promoting economic growth. On December 22, 2017, the President signed Public Law 115-96; extending the Regional Center Program through January 19, 2018.

USCIS policy on EB-5 adjudications is contained in Volume 6, Part G of the USCIS Policy Manual.

All EB-5 investors must invest in a new commercial enterprise, which is a commercial enterprise:

Established after Nov. 29, 1990, or

Established on or before Nov. 29, 1990, that is:

Purchased and the existing business is restructured or reorganized in such a way that a new commercial enterprise results, or

Expanded through the investment so that at least a 40-percent increase in the net worth or number of employees occurs

Commercial enterprise means any for-profit activity formed for the ongoing conduct of lawful business including, but not limited to:

A sole proprietorship

Partnership (whether limited or general)

Holding company

Joint venture

Corporation

Business trust, or

Other entity, which may be publicly or privately owned.

This definition includes a commercial enterprise consisting of a holding company and its wholly owned subsidiaries, provided that each such subsidiary is engaged in a for-profit activity formed for the ongoing conduct of a lawful business.

Note: This definition does not include noncommercial activity such as owning and operating a personal residence.

Job Creation Requirements

An EB-5 investor must invest the required amount of capital in a new commercial enterprise that will create full-time positions for at least 10 qualifying employees.

For a new commercial enterprise not located within a regional center, the full-time positions must be created directly by the new commercial enterprise to be counted. This means that the new commercial enterprise (or its wholly owned subsidiaries) must itself be the employer of the qualifying employees.

For a new commercial enterprise located within a regional center, the full-time positions can be created either directly or indirectly by the new commercial enterprise.

Direct jobs are those jobs that establish an employer-employee relationship between the new commercial enterprise and the persons it employs.

Indirect jobs are those jobs held outside of the new commercial enterprise but that are created as a result of the new commercial enterprise.

In the case of a troubled business, the EB-5 investor may rely on job maintenance.

The investor must show that the number of existing employees is being, or will be, maintained at no less than the pre-investment level for a period of at least 2 years.

A troubled business is a business that has been in existence for at least two years and has incurred a net loss during the 12- or 24-month period prior to the priority date on the immigrant investor’s Form I-526. The loss for this period must be at least 20 percent of the troubled business’ net worth prior to the loss. For purposes of determining whether the troubled business has been in existence for two years, successors in interest to the troubled business will be deemed to have been in existence for the same period of time as the business they succeeded.

A qualifying employee is a U.S. citizen, lawful permanent resident or other immigrant authorized to work in the United States including, but not limited to, a conditional resident, a temporary resident, an asylee, a refugee, or a person residing in the United States under suspension of deportation. This definition does not include the immigrant investor; his or her spouse, sons, or daughters; or any foreign national in any nonimmigrant status (such as an H-1B nonimmigrant) or who is not authorized to work in the United States.

Full-time employment means employment of a qualifying employee by the new commercial enterprise in a position that requires a minimum of 35 working hours per week. In the case of the regional center program, “full-time employment” also means employment of a qualifying employee in a position that has been created indirectly that requires a minimum of 35 working hours per week.

A job-sharing arrangement whereby two or more qualifying employees share a full-time position will count as full-time employment provided the hourly requirement per week is met. This definition does not include combinations of part-time positions even if, when combined, the positions meet the hourly requirement per week.

Jobs that are intermittent, temporary, seasonal, or transient in nature do not qualify as permanent full-time jobs. However, jobs that are expected to last at least 2 years are generally not considered intermittent, temporary, seasonal, or transient in nature.

Capital Investment Requirements

Capital means cash, equipment, inventory, other tangible property, cash equivalents and indebtedness secured by assets owned by the alien entrepreneur, provided that the alien entrepreneur is personally and primarily liable and that the assets of the new commercial enterprise upon which the petition is based are not used to secure any of the indebtedness. All capital shall be valued at fair-market value in United States dollars. Assets acquired, directly or indirectly, by unlawful means (such as criminal activities) shall not be considered capital for the purposes of section 203(b)(5) of the Act.

Note: The immigrant investor must establish that he or she is the legal owner of the capital invested. Capital can include the immigrant investor’s promise to pay (a promissory note) under certain circumstances.

Required minimum investments are:

General. The minimum qualifying investment in the United States is $1 million.

Targeted Employment Area (High Unemployment or Rural Area). The minimum qualifying investment either within a high-unemployment area or rural area in the United States is $500,000.

A targeted employment area is an area that, at the time of investment, is a rural area or an area which has experienced unemployment of at least 150 percent of the national average rate.

A rural area is any area not within either a metropolitan statistical area (as designated by the Office of Management and Budget) or the outer boundary of any city or town having a population of 20,000 or more according to the most recent decennial census of the United States.

5. INVESTOR VISA GREECE

Program Overview

The golden visa program in Greece offers an affordable real estate investment route to permanent residency in Europe. Following the launch of several European investment visa programmes it was introduced by the Greek government in 2013 to encourage investment into Greece.

Investment

An investment of €250,000 is required in real estate in Greece making the Greek programme the lowest investment level of any real estate residency visa scheme in Europe. The property, which can be located anywhere on the Greek mainland or the islands, can be either residential or commercial. Any number of properties can combine to make up the €250,000 minimum investment. Joint buyers can combine investments into one property.

Process

The application process takes approximately 40 days from the time of investment until the Residency Permit is issued. The applicant needs to have made the property investment in Greece prior to applying for the visa. Once a property has been selected through ourselves at La Vida, the

lawyers who we recommend can take care of the application process, conveyancing and legal work for the property.

A typical application involves initial discussion with ourselves followed by a 3 or 4 day visit to Greece to view properties, meet with lawyers and open a bank account. The application after this point can be processed within Greece by the clients’ lawyers under Power of Attorney. Provided everything is done correctly at this stage the client will not need to visit again to collect the residence permits.

Requirements

In addition to the real estate investment applicants will need a clear criminal record and medical insurance to cover any stay in Greece. There is no minimum stay requirement and the residency visa can be renewed after five years providing the investment is maintained.

Fees

Government, notary and lawyer fees for the property purchase and visa application will amount to around €15,000. In addition there is VAT of 24% to pay in Greece on new property purchases.

Family

Qualifying family members include spouse and all children under 18. Children 18 and over can qualify if studying and dependent. The Greek residency program was recently extended to the parents of both investor and spouse.

Taxes

Non-residents in Greece will pay tax on their income derived in Greece but not on income from outside of the country. Income tax starts at a rate of 22%. Rental income from property in Greece is taxed at rates, from 11% to 33%. Certain expenses are deductible from the gross income. Capital gains tax (CGT) is charged at 15% on property sales.

Living and Working

The residence permit allows the applicant to live in Greece but not to work. However the applicant can set up business in Greece.

Travel

Gaining visitor visas to travel to Europe and the Schengen zone has become problematic from many countries in the Middle East, Asia and Africa. Once granted the Greek residence permit allows freedom of travel throughout the EU Schengen zone.

Citizenship and Passport

Applicants who live in Greece can apply for citizenship and a passport after seven years. Once applicants have citizenship then they are free to dispose of their investment as further visa renewals are not necessary. Because of the need to reside in the country the Greek golden visa program is considered a residency investment program rather than citizenship by investment. However the option for citizenship is there for those committed to living in Greece.

Benefits

Applicants gain the right to live in Greece although there is no requirement to do this. With the residency card all family members will have freedom to travel to and throughout the EU Schengen

visa zone with ease and without further visa applications. If the resident sells the property to another non-EU citizen, the Greek residency becomes transferable to the new investor.

6. DOCUMENT CHECKLIST FOR IRELAND IMMIGRANT INVESTOR PROGRAMME

- Evidence of Identity

Passport of applicant (Notarized colour copy of every page) (Scanned copy)

Passport of spouse/partner (if applicable) (Notarized colour copy of every page) (Scanned copy)

Passport or dependants (if applicable) (Notarized colour copy of every page) (Scanned copy)

Two colour passport-size photos of applicant (Original)

Two colour passport-size photos of spouse/partner (Original, if applicable) Two colour passport-size photos of dependants (Original, if applicable)

- Evidence of Family Relationships (if applicable) (Scanned copy)

Evidence of legal

marriage/partnership Evidence of de facto relationship

Birth certificates of children

Evidence of guardianship/custody

Evidence of unmarried and in full-education for children between 18 to 24

III. Evidence of Funds (Scanned copy, see detailed information on the following pages)

Evidence of source of funds for investment (2 Million Euros)

Evidence of funds available for investment (1 Million Euros)

- Evidence of Good Character (Scanned copy)

Police report or character report from risk management consultancy for applicant (Each country that the applicant has resided for more than six months during the 10 year period prior to the application) Police report or character report from risk management consultancy for spouse/partner/ dependants (Above 16) included in the application (if applicable) (Each country that they have resided for more than six months during the 10 year period prior to the application)

- Original Application Form (Completed in Capital Letter and signed on Page 16 and 17 by the applicant)

Evidence of Net Worth

If you have to resort to all or part of the net assets of your accompanying spouse, to qualify for the threshold of €2m, both of you must complete this section. By disclosing his or her net assets, your accompanying spouse consents to place his or her funds at your disposal for fulfilling the commitments made under your application.

All of your assets and debts must be listed, with the exception of personal effects such as jewelry, art, etc.

To support your declarations, you must also enclose a narrative document (Or net worth report prepared by CPA or accountants) explaining the history of acquisition of your funds and, if applicable, those of your spouse who is accompanying you.

Part I. Explanation of Source of Funds

All applicants for the Immigrant Investor Programme must demonstrate that they have a legally acquired minimum net worth of €2 million.

The following sources of funds can be considered:

i) Business and investment activities | ii) Deeds of sale |

iii) Inheritance | iv) Divorce settlement |

- Your income (With related certificates, i. e. income certificates from employers, shareholders’ meeting resolutions, gifts certificates or inheritances proofs):

The job title and duration of the employment (If you changed functions during this period). Monthly salary.

Bonuses and commissions.

Dividends and annual income.

Gifts and inheritances and their source (In the case of a gift, explain the reason for it and the donor’s financial capacity to offer it).

Divorce settlement (If the applicant has obtained the required funding as a result of a divorce settlement, a notarized copy of a financial agreement following a divorce should be provided together with a letter from a registered legal adviser permitted to practice in the country where the divorce was decreed. Where the applicant has received possessions or assets, rather than money, estimates of the value of the items will not be accepted as evidence of funds available for investment).

- Your investments (Related documents for investment shall be provided)

The nature and amount of the investment in the enterprise.

The percentage (%) of shareholders’ equity acquired.

The names of the shareholders and their equity interest in the enterprise and, as the case may be the name of the shareholder who sold his equity interest.

The origin of the funds that allowed this investment.

The registered capital of the enterprise following the transaction, as the case may be:

The purchase price of real estate property acquired during this period.

The amounts of personal investments.

Purchases of shares or other securities and the investment income that you derived from them

- Your loans (With bank statements showing the fact if applicable)

Bank loans and the date of repayment of such loans.

Mortgage loans contracted and the date on which you repaid your mortgage.

Any other type of loan.

Part II. Evidence of Funds for Investment (At least €1 million)

The applicant must provide evidence of the funds that are to be used for the proposed investment, the provenance of those funds and the ability of the applicant to transfer those funds to Ireland. This should be done by:

- A letter from a financial institution regulated by the Central Bank of Ireland (or);

- If the funds are not held in a financial institution regulated by the Central Bank of Ireland (or);

Personal bank statements from a bank that is regulated by the home regulator (official regulatory body for the country in which the financial institution operates and the funds are located).

Showing the amount of funding available in the name of the applicant.

The applicant should provide bank statements, covering the three full consecutive months before the date of application.

The most recent statement must be no more than one calendar month old at the date of application.

All bank statements provided must be original documents and not copies, be on the official bank stationery and each must show the full amount of the available funds.

- A letter from a bank that is regulated by the domestic regulator (Official regulatory body for the country in which the financial institution operates and the funds are located):

If the applicant cannot provide bank statements, INIS will require a letter from his/her bank, stating that the account has held the required amount of money on the day the letter was produced and for the three full consecutive months immediately before the date of the letter. The letter must be dated no more than one calendar month before the date of application. The letter must be an original letter and not a copy; on the institution’s official headed paper; and it must have been issued by an authorized official of that institution. The letter must confirm the following:

The name of the applicant, and that the money is available in their name/s. The bank is regulated by the home regulator.

The dates of the period covered. This must include both the day the letter was produced and three full consecutive months immediately before the date of the letter; and

The balance of the account to cover the amount claimed as a credit balance on the date of the letter and the three full consecutive months before the date of the letter.

If the letter does not confirm a minimum sufficient credit balance for the full period required, the applicant must also provide further evidence of the source of the money, from the list below.

* All funds must be acquired and held legally and must be fully at the free disposal of the applicant and can be transferred to Ireland.

Part III. Demonstration of Net Worth

Besides the above €1 million from banks, your assets may include the following:

Real Estates owned by applicants with appraisal reports stating the current market value.

Company assets if applicants are shareholders; in such cases, financial reports should be provided by CPA to show the said company assets.

IIP FEE LIST

Investment & Admin Fee | Currency: EUR |

Item | Amount | Note |

Investment | 1 Million EUR | To be repaid after 3 years with return 2% per year(totally 6% ) |

Admin Fee | 70,000 EUR | 1. Project management fee |

Other Fee 1 – Investor pays | Currency: EUR |

Item | Amount | Note |

Visa Application | Depends | Visa application shall be submitted after IIP approval for the family; |

Flight ticket and Hotel | Depends | For visiting Ireland to get stamp4 |

GNIB Card | 300 EUR/person | Pay to INIS when landing (only for people above 16) |

Re-entry Visa Fee | 100 EUR/person | Pay to INIS when landing |

Health Insurance | Depends | Need to buy insurance for the first 5 years covering residence period in Ireland, only need to buy before landing. |

Other Fee 2 – investor pays | Currency: EUR |

Item | Amount | Note |

Notary Fee | Depends | Depends on Notary and country |

Translation Fee | Depends | Depends on workload of the translation agency and country (if original doc is not English) |

Property Valuation | Depends | Depends on sets of properties and country |

Net Worth Report | Depends | Depends on CPA |

7. PORTUGAL

Introduction:-

The Investment in Portugal developed and managed by the well known and experienced Crown Land Developers & Builders LLC, and is deposited at Banco Millennium BCP.

It has as main objective the capitalization of Portuguese companies that will invest in areas that are performing well and bringing high returns. The competitive advantage of the fund is due to the fact that the management team presents, for each investment a clear Entry and Exit Strategy for all their investors, with always good returns on their investments (ROIs).

Crown Land Developers is managed by a Local Experience Team with various backgrounds such as Real Estate Investment consultants and Tourism Industry experts that developed a methodology for investors to profit from one of the most dynamic Markets in Europe: PORTUGAL.

By investing on the value of 350.000 Euros, the investor is immediately qualified for a RESIDENCE PERMIT in Portugal (Golden Visa) and after 6 years able to apply for Citizenship.

Investment:

Crown Land Developers will follow a strategy focused on capitalising SME (Small and Medium Enterprises) Portuguese companies that will invest in the 2 most profitable industries in Portugal: Real Estate and Tourism.

The Fund has the commitment of investing only in projects that the Entry and Exit Strategy is clear and with low risk, having guarantees over 120% of investment.

Our Crown Group team developed partnerships with local agents that easily access the potential buyers for the Real Estate Assets being developed by local performing companies.

Investment will be focus in developing new real estate assets which are having a high demand and generate results through sales and rental income.

Invsest Safe in One of the

Most Dynamic Real Estate markets

The last year was one of the best year in the last decade for the Real Market in Portugal. The trend for the coming years is of growth and consolidation of this market.

REAL ESTATE IN PORTUGAL:

The last year was one of the best years in the last decade for the Real Estate Market;

Average capital gains in main Portuguese cities from 2014 to 2016: 12%/ year;

Expected Average capital gains in main Portuguese cities from 2016 to 2019: 17%/ year

Trends:

For the coming years the market will clearly grow and consolidate;

Demand for properties will increase due to tax incentives and investment programs launched by Portuguese authorities (Golden Visa and NHR)

Low supply of Real Estate products and Low interest rates on deposits will increase Investment in properties

TOURISM IN PORTUGAL:

The Tourism is by far the most important industry in Portugal since long;

Portuguese tourism industry in 2016 smashed all the records yet again. The report of the National Statistics Edition (INE) stated that the overnights stays increased, the guests increased, the occupancy rate increased, and the revenues increased as well. Portuguese tourism achieved one of the best European performances

The national accommodation establishments hosted around 19 million guests (of which more than 11 million were from abroad), corresponding to more than 53.5 million overnight stays.

Portugal’s tourism revenues increased by 10.7% last year, for a total of 12.68 billion euros. The Portuguese tourists, in turn, spent 3.84 billion abroad, with the tourism balance surpassing the 8.8 billion mark. This means that, in 2016, tourism represented about 68% of the balance of services, whereas the balance of goods and services (which registered in 2016 a balance of about 4 billion) would be a loss- maker without tourism.

TOURISM IN PORTUGAL:

Portugal | 2016 | 2016 | 2017 | USDbn¹ | 2027 | Growth³ |

Direct contribution to GDP | 13.3 | 6.4 | 2.8 | 16.6 | 7.3 | 2.2 |

Total contribution to GDP | 34.4 | 16.6 | 2.6 | 42.6 | 18.5 | 1.9 |

Direct contribution to employment4 | 371 | 8.1 | 3.4 | 441 | 9.6 | 1.4 |

Total contribution to employment4 | 905 | 19.6 | 3.0 | 1,034 | 22.6 | 1.0 |

Visitor exports | 16.7 | 20.5 | 3.8 | 22.6 | 22.0 | 2.7 |

Domestic spending | 8.2 | 4.0 | 0.7 | 9.0 | 3.9 | 0.9 |

Leisure spending | 21.1 | 5.3 | 2.9 | 26.6 | 6.1 | 2.1 |

Business spending | 3.8 | 1.0 | 2.3 | 5.0 | 1.2 | 2.4 |

Capital investment | 3.0 | 9.8 | 2.4 | 3.7 | 10.2 | 2.1 |

‘2016 constant prices & exchange rate; ² 2017 real growth adjusted for inflation (%); ³ 2017-2027 annualised real growth adjusted for inflation(%);4000 jobs

THE ECONOMIC CONTRIBUTION OF TRAVEL & TOURISM: REAL 2016 PRICES:

TOURISM IN PORTUGAL:

SHORT RENTAL MARKET IN PORTUGAL:

Low interest rates on bank deposits increased the investment in properties. Owners are able to place those properties in Short rental market for Tourists

Programs like the Golden Visa Resident Permits obliged investors, that were not willing to relocate to Portugal, to invest in Real Estate. Those properties are being managed by local property management companies that rent them on a short rental basis to tourists.

SHORT RENTAL MARKET IN NUMBERS:

42.000 units registered to be rented out in a short rental basis

Just AirBnB guarantees that 1.66 Million Euros Income were generated in this platform to owners of properties in Portugal

The same platform states that, only in 2016, they managed to receive 1,6 Million Visitors and generated a 1.07 Billion Euros in economic activity

2014 to 2016: 204% was the increase of properties registered in Portugal for Short Rental

INVESTORS

(Golden Visa Applicants)

Fund Manager – LINCE

INVESTMENT FUND

Investors have several Exit Strategy

Development of Real Estate Assets

Touristic properties

Entry Strategy:

Investment Profile:

Investment in Portuguese SME (SPV) that will develop new Real Estate Assets and Touristic services that will generate profits for the Fund

Minimum Investment: 350.000 Euros

Investment over the Minimum in multiples of 50.000 Euros

Minimum Investment Period: 7 years

Expected Annual Profit: 4 to 6%

Annual Profit Distribution: 50% of the profits

Exit Strategy:

Investment Profile:

The Fund allows investors ways to abandon the Investment:

Complies with 7 years investment is able to benefit from the yearly profits and total Return on Investment at year 7.

Sell the Shares to other investor (10% commission charged and profits deducted)

Exchange the shares for Real Estate assets from the SPVs (Based on Assets Selling price)

The fund will focus on leveraging SPVs that create, sell and short rent New Real Estate Assets for their own clients

SIF is an Investment Fund that allows Investors to benefit from a residence Permit in Portugal, during the years of the investment, Permanent Residence after 5 years and citizenship after 6 years.

Lower Income Tax. Reduce investment compared with alternative of owning Real Estate Asset.

High Return on Investments (ROIs) (Expected 15 to 25% during 7 years)

Experienced Team Managing The Funds – LINCE CAPITAL SCR SA

Multitasked and credible Team Managing the SPVs with several years experience in Real Estate Investments and Property Management

8. SPAIN GOLDEN VISA

Golden Visa Spain with €500,000 investment.

Spain launched its golden visa programme in 2013. An investment of €500,000 in real estate will gain family residency. The Spanish investor visa can be renewed every two years. After five years it is possible to gain permanent residency and after ten years citizenship. It is not necessary to live in Spain in order to retain and renew the residency visa permit.

Permanent Residency and Citizenship

It is possible to apply for permanent residency in Spain after living in the country for five years. Citizenship can be applied for after living full time for ten years.

Although the temporary residency permit (the golden visa) can be easily renewed without living in the country, the route to both permanent residency and citizenship requires the investor and their family to reside in Spain.

Permanent Residency and Citizenship

It is possible to apply for permanent residency in Spain after living in the country for five years. Citizenship can be applied for after living full time for ten years. Although the temporary residency permit (the golden visa) can be easily renewed without living in the country, the route to both permanent residency and citizenship requires the investor and their family to reside in Spain.

Key Facts

Investment of €500,000

Full family residency

Flexible. No requirement to reside.

Permanent Residency from 5 years

Citizenship from 10 years

EU Schengen visa travel

Property Investment

After several years of price declines real estate is now at rock bottom prices and the Spanish property market offers considerable potential for capital gains in the coming years. Investors need to consider their purchase carefully. Is it for investment and rental or lifestyle? There are many offers on the market from developers and banks but location and property type is critical to the success of the investment. Investors needing our services may wish to check our procedure or read more detail for the golden visa programme in Spain. To contact us, speak to an expert and for further details on the procedures and our property portfolio enquire here .

Compare Golden Visa Programmes

Spain is not the only country in Europe offering a golden visa programme and residence permit through real estate investment. Visit our pages on Portugal and Greece to compare the immigration investment requirements and benefits of their golden visa residency programs and also the citizenship by investment programs inCyprus and Malta .